SyliusVIESClient Plugin

by Prometee

by Prometee

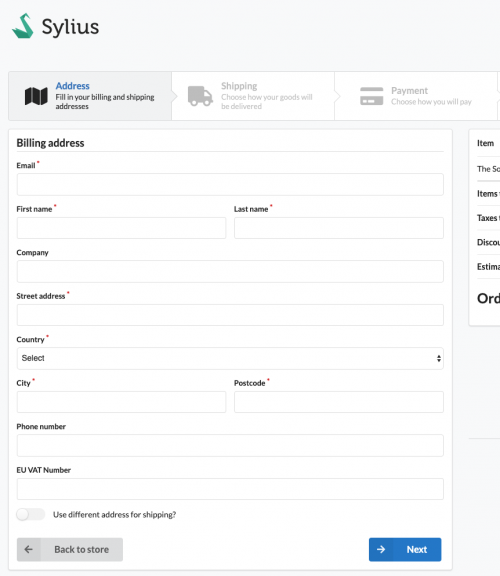

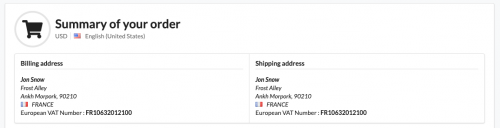

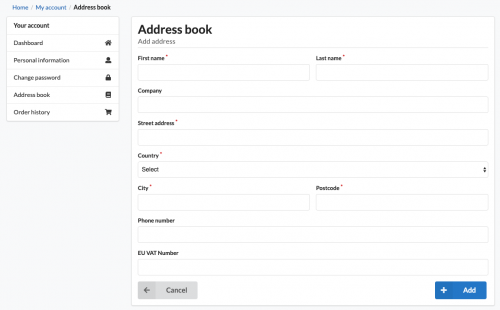

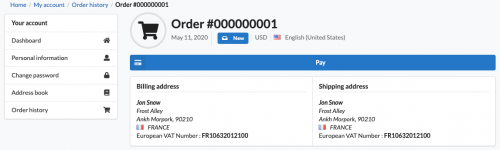

This Sylius Plugin allows you to add European VAT Numbers to the addresses and manage the European VAT number rule.

You may also like

SyliusStripePlugin by FLUX

FLUX

Sylius ^2.0 plugin to support Stripe Checkout and Stripe Web Elements.

0

Free

ForceLoginPlugin by bitExpert

bitExpert

The plugin allows you to restrict which pages a visitor is able to see.

0

Free

TopBarNotificationPlugin by Magenable

Magenable

A plugin for Sylius which displays top bar notifications on the shop.

0

Free